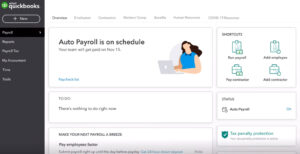

I found QuickBooks comparatively simple to navigate and enjoyed the guided approach to setting up your payroll system. You can mess around with the software to get a feel for it before operating your first payroll or adding your employees. QuickBooks also runs promotions for its payroll product incessantly, so be positive to verify for any obtainable discounts earlier than buying. QuickBooks Online Payroll presents a 30-day free trial, however if you opt to strive before you purchase, you’ll miss out on a 50% off “buy now” promotion. QuickBooks On-line Payroll scores a lower rating within the pricing class due to its higher-than-average cost, lack of a discounted annual plan choice, and pricey add-ons. Nevertheless, the software will get points for pricing transparency and plans which might be generously packed with features.

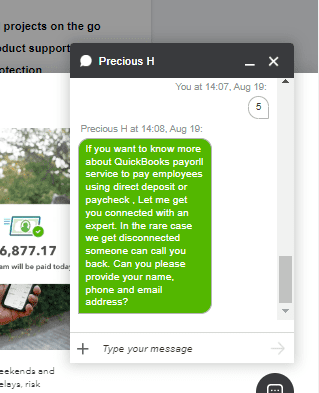

QuickBooks Payroll offers a 30-day free trial, the standard size of a free trial in this industry. Nevertheless, some firms, corresponding to Rippling and Paycor, don’t allow you to try before you purchase. Different suppliers, like Roll by ADP, beat QuickBooks on this area, offering a three-month free trial. However, different users have reported subpar customer support experiences. QuickBooks Payroll users complain that customer assist is commonly difficult to understand due to outsourced, out-of-country support. They also report representatives’ inability to fix person issues, long waiting occasions and frequent dropped calls.

- We spend money on deep research to help our viewers make higher software buying selections.

- Neither has the flexibility for workers to trace time, and you additionally can’t pay them instantly by way of the software, corresponding to with QuickBooks Premier.

- Small companies want entry to a various array of accounting features and integrations at an inexpensive value point to help them manage their funds.

- QuickBooks Payroll provides automated tax calculation, filing, and cost companies for both state and federal taxes.

- These measures ensure that monetary information remains private and protected from potential threats.

If you have no price range to spend on payroll and only need basic service, you can also pay your employees for free utilizing tools like Payroll4Free. QuickBooks Payroll, developed by Intuit, stands out as an exceptional application https://www.intuit-payroll.org/ tailor-made for small companies to streamline employee payroll management. Whereas it is optimized for managing payroll for up to 50 employees, it could possibly handle payroll tasks for as much as a hundred and fifty staff efficiently. Nevertheless, for businesses that are on the lookout for a payroll software program answer that offers in depth options with out an exorbitant price ticket, Gusto is the way to go. Intuit has many features to help you manage your workers and contractors from a single interface.

Payroll Premium + Plus

Learn more about our full course of and see who our companions are right here. Intuit workforce portal is an employee self-service platform that enables workers to view their paychecks and W-2s. They can also apply for go away, view go away balances and enter time sheets on the portal. You can choose whether or not you want your workers to have entry to the workforce portal or not whereas adding their names to the payroll database. QuickBooks Payroll has some 20 reviews, similar to payroll billing summary, payroll deductions and contributions, payroll tax legal responsibility, total pay, workers’ compensation, and so forth.

Standout Options (25% Of Ultimate Score)

The editorial content material on this page is not provided by any of the companies mentioned and has not been reviewed, accredited or in any other case endorsed by any of these entities. Our Gusto vs. QuickBooks Payroll comparison takes a deeper look into the differences between QuickBooks On-line Payroll and Gusto, together with pricing, features, and more. The Higher Business Bureau provides Intuit QuickBooks a great rating general, but if you delve deeper into the critiques specifically for the payroll program, things turn ugly in a rush. QuickBooks Online Payroll’s ranking within the user review category displays its notably high 4.5/5 star score across consumer review sites and its optimistic feedback on other platforms.

Issues stem from the complexity of making simple fixes, corresponding to miscategorizations or duplicate entries. Support is proscribed, so customers are left studying assist articles somewhat than getting a stay particular person to help. Cash movement providers are delivered to you by Intuit Funds Inc. topic to eligibility criteria, credit score and utility approval. The Net Emotional Footprint measures high-level user sentiment in course of specific product choices. This may be differentfrom information contained in reviews and awards, which express data as of theirpublication date.

Do I Want An Accountant If I’ve Quickbooks?

All in all, although QuickBooks Payroll doesn’t tick all the extra boxes, they still have lots to supply. QuickBooks Online and QuickBooks Payroll are two separate merchandise. QuickBooks Online is a cloud-based accounting software solution for small companies, whereas QuickBooks Payroll is a cloud-based small-business payroll answer. The two merchandise combine easily with one another, which suggests it’s straightforward to add a QuickBooks payroll plan to your QuickBooks accounting subscription and vice versa. If you’re in search of comprehensive HR and employee-benefit options on top of fundamental payroll duties, QuickBooks Payroll won’t be the best fit. Sure, it offers all of the basics, like staff compensation insurance, medical insurance administration, and 401(k) plans.

QuickBooks Premier includes more than a hundred and fifty industry-specific stories that will help you better manage your finances. It additionally comes with the power to trace sales, customer funds, product costs and extra. QuickBooks On-line is a good option for many small companies that are wanting to make invoicing customers easy and combine invoicing and payments into the overall ledger. Small companies can customize how they use the platform so that they solely use the features they want. Phrases, circumstances, pricing, special options, and service and support options topic to change with out notice.

You can add varied details, including job titles, payment info, day off, tax documents, and benefits. Intuit allows you to handle further earnings, deductions, and garnishments. Employers also can customise their time-off insurance policies and monitor how much day off an employee or contractor has accrued. Though Intuit (QuickBooks’ parent company) has a A- ranking with the Higher Business Bureau (BBB), customers have logged greater than three,one hundred complaints.

QuickBooks Payroll is out there in all 50 states, but the Core and Premium services embrace free tax filing for one state only. QuickBooks Payroll Elite plan companies embrace free multi-tax state and federal tax submitting. As Soon As you arrange your account or free trial, connecting your bank account to QuickBooks takes only a few minutes. If you want implementation assist, you should buy a one-time session with a bookkeeper. They will stroll you thru setting up your chart of accounts, connecting your bank accounts and automating processes. Though this perk costs further, we like that less tech-savvy business house owners can receive hands-on assistance at a comparatively low value point.