In the realm of small enterprise accounting, managing customer funds and outstanding invoices is essential to sustaining operations and maintaining correct financial data. This unlucky actuality has prompted enterprise owners to undertake practical strategies for dealing with unpaid money owed. Amongst these, the direct write-off method stands out as a straightforward way to manage and record dangerous debts when they turn into irrecoverable. One of her prospects bought merchandise worth $ 1,500 a yr ago, and Natalie nonetheless hasn’t been in a place to gather the fee.

The Direct Write Off Technique Vs The Allowance Methodology

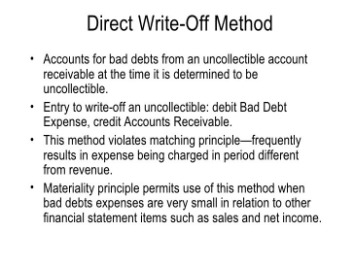

If most of your customers pay on time and also you solely have just a few bad apples, this methodology might be adequate. Now, if your business frequently extends credit, has excessive receivables, or needs to adjust to GAAP, you may want to have a look at the allowance method instead. The direct write-off methodology doesn’t conform to the matching precept in accrual accounting.

Businesses can solely take a nasty debt tax deduction in certain conditions, usually using what’s referred to as the “charge-off technique.” Read extra in IRS Publication 535, Business Expenses. Bad debt, or the lack to collect cash owed to you, is an unlucky actuality that small enterprise owners should occasionally deal with. You’ll have to decide how you need to record this uncollectible money in your bookkeeping practices. Managing these impacts fastidiously helps provide stakeholders with a transparent view of the business’s monetary position. This maintains the matching of revenue and expenses in the same period, preserving monetary statement integrity.

Sustaining accurate and up-to-date data also plays an important role in the successful implementation of the Direct Write Off Method. Credit management doesn’t have to come back on the expense of optimistic customer relations. When internal assortment efforts fail, businesses could resort to authorized treatments similar to small claims courtroom, arbitration, or hiring debt assortment companies. Integrating this follow into routine financial management promotes proactive credit control. Communicating this coverage clearly to clients ensures mutual understanding and reduces disputes.

Reporting revenue and bills in different intervals can make it difficult to pair gross sales and bills and belongings and net income can be overstated. To keep the business’s books correct, the direct write-off technique debits a foul debt account for the uncollectible amount and credit that same amount to accounts receivable. This distortion goes against GAAP rules as the stability sheet will report extra income than was generated. This is why GAAP doesn’t allow the direct write off method https://www.simple-accounting.org/ for financial reporting. GAAP mandates that expenses be matched with revenue throughout the identical accounting period.

The direct write-off methodology is used solely when it is inevitable that a customer will not pay. There is no recording of the estimates or use of allowance for the uncertain accounts underneath the write-off strategies. In different words, it may be mentioned that whenever a receivable is taken into account to be unrecoverable, this technique absolutely permits them to e-book those receivables as an expense with out using an allowance account.

Industry practices in unhealthy debt accounting differ primarily based on the scale, nature, and complexity of the enterprise. Understanding these practices helps companies select the most applicable methodology for managing bad money owed effectively. Understanding the theory behind the direct write-off methodology and the allowance technique is important, but applying these accounting practices effectively can pose actual challenges.

Provide An In Depth Instance Of The Method To Estimate And Adjust Allowances For Unhealthy Debt

- On the opposite hand, utilizing the Allowance Methodology, the company may estimate that 5% of its credit score gross sales shall be uncollectible primarily based on previous expertise and current economic conditions.

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, advisor, college instructor, and innovator in instructing accounting on-line.

- The direct write-off method provides an easy, albeit typically less timely, approach to recognizing uncollectible accounts, making it suitable for smaller businesses or these with minimal dangerous debt publicity.

- Leveraging technology and investing in workers training further enhances these efforts.

- By streamlining the billing course of and minimizing confusion, businesses reduce friction and make it simpler for purchasers to pay throughout the expected timeframe.

Beneath the Direct write Off Methodology, a credit memo is created to write down off the accounts receivables of the client under consideration. The credit memo is created by debiting the unhealthy debt expense account and crediting the accounts receivable account. In the Direct write Off Method of accounting, the amount of the dangerous debt expense is elevated and does not involve any reduction in the amount of the sale recorded in the books of accounts.

The Direct Write Off Technique And Gaap

As in, Expenses must be reported in the period during which the company has incurred the revenue. For example, think about a company that extends credit score to a brand new buyer without a thorough credit score verify. The buyer makes a big buy, which is recorded as income, boosting the corporate’s sales figures. However, when the shopper fails to pay, the corporate should write off the debt, causing a sudden and important hit to its earnings.

For these reasons, the accounting profession doesn’t allow the direct write-off technique for financial reporting. Furthermore, the allowance methodology requires businesses to take care of a separate account for the allowance for uncertain accounts. This account needs to be regularly adjusted, which provides complexity to the accounting process. Additionally, the allowance methodology might end in a delay in recognizing dangerous debts because the estimation course of just isn’t instant. Whereas the Direct Write-Off Technique is straightforward and direct, its delayed recognition of dangerous debt and non-compliance with GAAP make it much less fascinating for correct financial reporting.